Key Takeaways

- MicroStrategy shareholders will vote on growing the licensed frequent inventory to 10.3 billion shares.

- The vote will think about amendments to the corporate’s fairness incentive plan and procedural modifications for board administrators.

Share this text

MicroStrategy shareholders will vote on key proposals to spice up licensed shares and revise the fairness incentive plan—a strategic transfer in assist of the corporate’s Bitcoin technique.

“The proposals we’re asking you to contemplate mirror a brand new chapter in our evolution as a Bitcoin Treasury Firm and our bold objectives for the long run,” MicroStrategy co-founder and government chairman Michael Saylor acknowledged.

The vote is ready to happen at a particular assembly in 2025; the precise date will likely be disclosed subsequently, based on a current discover filed with the SEC.

The assembly, to be held through webcast, will permit stockholders of report as of a to-be-determined date in 2025 to vote on 4 proposals, together with growing frequent inventory to 10.3 billion shares from 330 million and most popular inventory to 1 billion shares from 5 million.

The proposed enlargement is aimed toward supporting the ’21/21′ plan which entails elevating $42 billion to fund future Bitcoin acquisitions in three years. Saylor stated final week the corporate would re-evaluate its capital allocation technique as soon as the $42 billion goal is met.

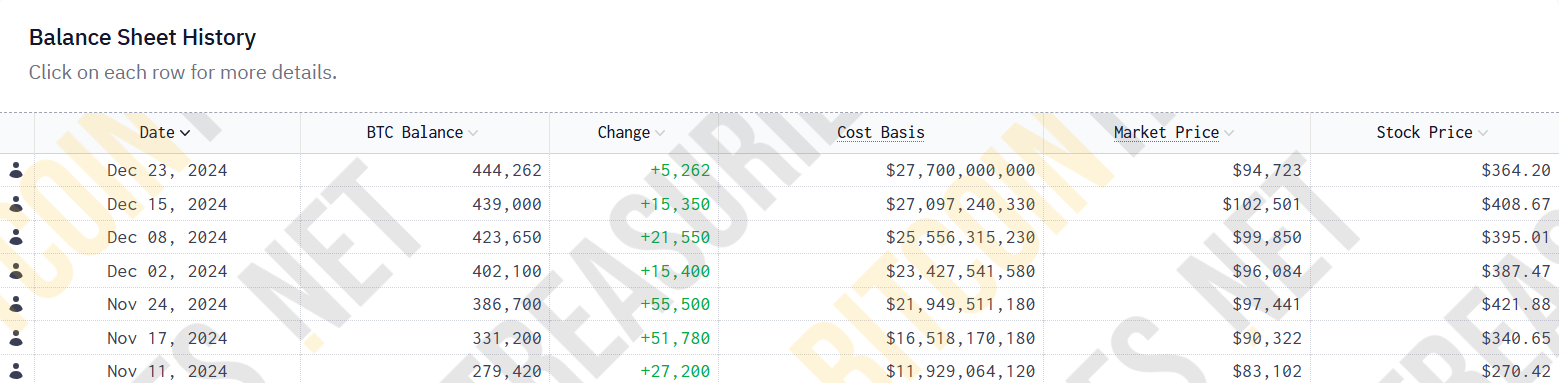

Since asserting its plan, MicroStrategy has acquired round 192,042 BTC value round $18 billion. This implies it has achieved roughly 42% of its deliberate funding purpose in lower than two months.

The Virginia-based firm additionally seeks stockholder approval to amend its present fairness incentive plan. If permitted, the modification will mechanically grant three newly appointed administrators—Brian Brooks, Jane Dietze, and Gregg Winiarski—fairness awards valued at $2 million upon their preliminary appointment to the Board.

This proposal displays the corporate’s technique to draw and retain certified administrators because it continues to concentrate on its Bitcoin acquisition technique.

Shareholders may also resolve on a procedural measure permitting for assembly adjournment if there are inadequate votes to approve any proposals, enabling further vote solicitation if wanted.

MicroStrategy’s proposals come after its inclusion within the Nasdaq-100 index took impact on December 23. The transfer is anticipated to result in elevated shopping for from index-tracking funds, reminiscent of the favored Invesco QQQ Belief, which may improve MicroStrategy’s inventory liquidity and visibility amongst traders.

Share this text