On-line funds and fintech innovations have demonstrated outstanding metamorphosis previously 5 to 10 years.

Cheques and money have been virtually utterly changed by cell wallets and digital banking, and what as soon as required a visit to the financial institution can now be completed with a couple of faucets on a smartphone.

There are disagreements in 2025, nonetheless, on whether or not this development will proceed or decelerate. Disaster, regulation, and sustainability challenges to monetary providers all affect the funds trade in 2025.

There are a number of choices and methods of influencing the state of affairs, daring and humble. In the previous couple of years, the most definitely contender for the function of a web based fee instrument has been blockchain know-how.

What Is Blockchain Expertise in Funds?

In essence, blockchain is a digital ledger that’s shared throughout a community of computer systems. As a substitute of getting to contain a financial institution or fee gateway to trade cash, blockchain lets a set of customers group collectively and ensure the transaction.

This fashion, you don’t have a intermediary concerned, which saves time and money, and makes the entire course of extra clear.

Usually, sending cash overseas takes days and will get routed by varied banks. On blockchain, the very same switch could be performed in a matter of seconds, with a lot fewer prices and far much less problem.

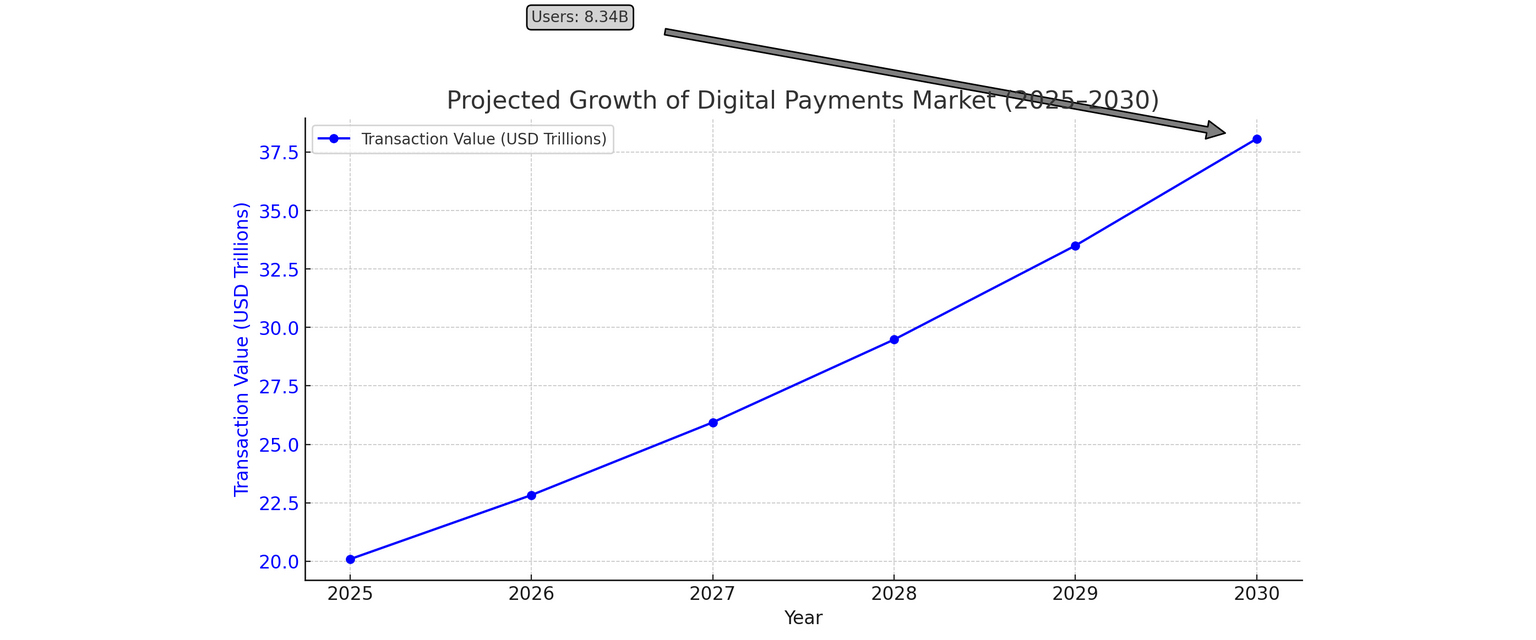

Projected Progress of Digital Funds Market (2025–2030)

Key Advantages of Utilizing Blockchain in Funds

Blockchain is getting lots of consideration on this planet of funds, and for good cause. It solves most of the issues we’re used to coping with when sending or receiving cash.

Initially, cross-border funds and old school funds can take days to settle. With blockchain, quite the opposite, the identical monetary transaction could also be settled in minutes or seconds. That’s an enormous distinction, particularly for individuals or companies that want cash to maneuver rapidly.

Second, common financial institution transfers typically incur extra charges, probably from a number of banks that deal with the transaction. Blockchain, in flip, cuts out middlemen, saving customers’ cash on every operation.

The following enormous profit is transparency. All blockchain transactions are positioned right into a public document ebook that may’t be manipulated. So everybody can see what’s occurring and could be sure the data is correct.

And in contrast to banks, blockchain doesn’t respect weekends. Funds exit or are available in 24/7 with out regard to time or day. Neither does it require a standard checking account, so these with out entry to banking services can nonetheless put it to use to ship and obtain cash.

Quick and candy, blockchain funds are quicker, cheaper, safer, and extra versatile in comparison with lots of what exists right now. It’s an rising know-how, however already it’s offering us with a greater technique of sending cash.

| Function | Conventional Methods | Blockchain-Primarily based Funds |

| Pace | 1–5 days (cross-border) | Seconds to minutes |

| Charges | 3–7% | Usually lower than 1% |

| Transparency | Low | Excessive |

| Availability | Financial institution hours | 24/7/365 |

| Safety | Centralized, breach-prone | Decentralized, encrypted |

| Belief Mannequin | Third-party establishments | Distributed consensus |

Blockchain vs. Conventional Fee Methods: A Comparability

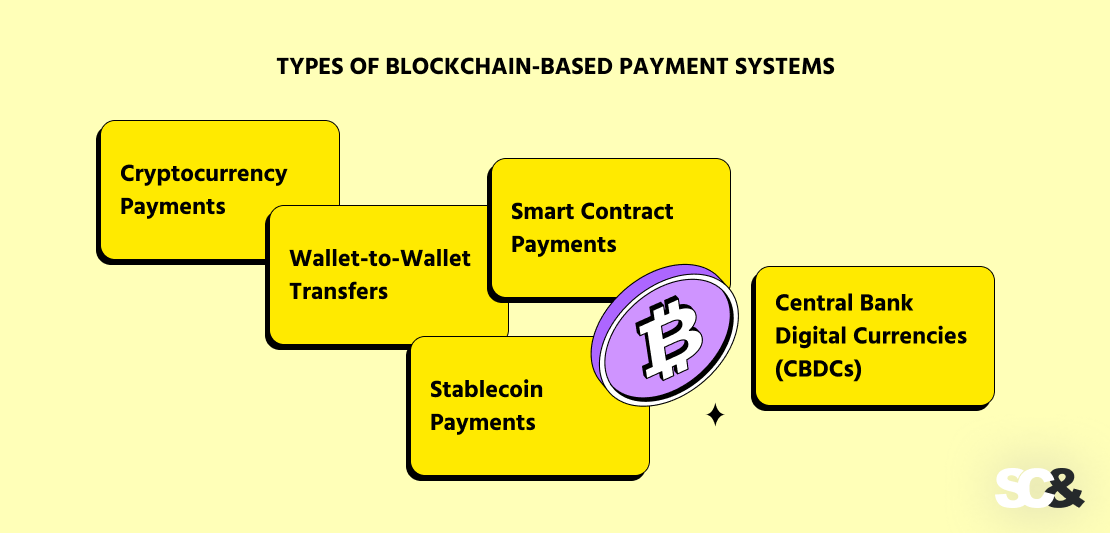

Varieties of Blockchain-Primarily based Fee Methods

Within the yr 2023, central banks globally have been unsure concerning the long-term place of blockchain in worldwide funds.

Nevertheless, as of 2025, blockchain opens up multiple channel to ship cash. Relying upon necessities, companies can select the kind of blockchain-based fee system that matches greatest.

1. Cryptocurrency Funds

That is the traditional one. Folks pay utilizing digital currencies, akin to Bitcoin (BTC), Ethereum (ETH), or stablecoins like USDT or USDC. Total, cryptocurrency funds are nice for reaching international customers, particularly in territories with rigid banking providers.

2. Pockets-to-Pockets Transfers

The wallet-to-wallet kind is a direct transaction between two blockchain wallets. One particular person sends cash to a different particular person with out utilizing banks or intermediaries. It may be completed by scanning a QR code or copying a pockets tackle.

Generally, it’s an amazing match for marketplaces, tipping options, donations, or apps the place prospects pay one another (like ride-sharing, freelance, or content material creation apps).

3. Good Contract Funds

Good contracts are self-executing packages that run on the blockchain. They routinely ship funds when sure circumstances are met — nobody has to press a button.

By and enormous, good contracts are helpful for automating milestone-based freelancer payouts, subscription renewals, or income splits. As soon as arrange, they run on their very own and scale back guide work.

4. Stablecoin Funds

Stablecoins are digital property tied to actual cash (for instance, the US greenback) and are due to this fact much less unstable than Bitcoin or Ethereum.

This fashion, stablecoin funds are an excellent choice to make the most of for those who require quick, cheap transfers with out the volatility threat of worth modifications, akin to cross-border payrolls, provider funds, or subscription invoices.

5. Central Financial institution Digital Currencies (CBDCs)

CBDCs are digital variations of government-issued cash, akin to a greenback or euro. Some nations are already experimenting with them, and lots of states expect them to switch money.

As believed, CBDCs can supply the pace of blockchain funds with the authorized backing of central banks. In case you’re in a regulated trade or take care of authorities purchasers, that is one thing price ready for.

How the Blockchain Fee Course of Works: Step-by-Step

Making a blockchain fee may sound too technical, however underneath the hood, it’s only a collection of actions that each one occur fairly rapidly.

In case you’re contemplating including a blockchain-powered fee system to your app, platform, or service, it’s good to know what’s occurring and what it means for your online business operations.

1. A Person Makes a Fee

Usually, the method begins with a person — a client trying out, a freelancer getting paid, or a business-to-business bill. They open their digital pockets, enter the tackle of the recipient, decide how a lot to ship, and click on “ship.”

For companies: You may combine a pockets straight into your software or hook up with widespread ones like MetaMask or Coinbase Pockets. The thought right here is to make it as seamless as attainable in your customers to ship funds.

2. The Transaction Goes to the Community

As soon as the fee is shipped, the transaction is broadcast to the blockchain community. It’s picked up by a community of computer systems (nodes) which guarantee it’s legitimate, for instance, that the sender really has the funds.

For corporations: Your app will often use a service like Infura or Alchemy to broadcast this transaction and comply with it. You don’t must host a blockchain server your self until you want full management.

3. The Community Confirms It

The transaction is then picked up and confirmed. This could take seconds or minutes, relying on the blockchain. The community confirms the fee utilizing its built-in verification course of (this could possibly be “proof of labor,” “proof of stake,” or one thing else).

For companies: Choosing the proper blockchain is necessary right here. Some are inexpensive and faster than others. In case you want fast funds (e.g., at checkout), look into blockchains like Solana, Polygon, or Stellar.

4. The Fee Is Added to the Distributed Ledger

When verified, the transaction is put into a brand new block, and that block is appended to the blockchain. Now the fee is secured and may’t be modified. It’s everlasting and traceable.

For companies: That is the place blockchain actually makes a deal. You might have a safe, tamper-proof document of fee. You can too set off computerized actions (like transport a product or updating a database) when fee is made.

5. The Recipient Will get the Cash

The corporate or particular person you paid could have the funds of their pockets as quickly because the community confirms it. Relying on the blockchain you’re on, this may be virtually instantaneous.

For companies: You should utilize this affirmation as a set off to ship a receipt, activate a subscription, unlock content material, or launch an order. It’s all programmable, time-saving, and minimizes errors.

Optionally available: Actual-Time Monitoring

You can too give customers real-time standing on their transaction, identical to you’ll monitor a bundle. This builds belief and retains customers knowledgeable.

For companies: Most apps use APIs or libraries (like Web3.js or Ethers.js) to verify whether or not a transaction is pending, confirmed, or failed. You may even present hyperlinks to blockchain explorers like Etherscan for further transparency.

Use Circumstances of Blockchain in Funds

Once more in 2023, about one in 4 interviewees believed blockchain would have an eventual footprint. 15% of interviewees acknowledged solely home makes use of of blockchain funds, versus 13% believing in cross-border purposes.

Virtually, blockchain funds are already being utilized in a variety of industries and real-world conditions, serving to repair ache factors which have existed in finance for years.

1. Sending Cash Throughout Borders (Remittances)

Sending cash abroad by a financial institution or cash switch enterprise prices days and a fortune in charges. Ceaselessly, a number of banks are used alongside the way in which, every charging its personal price.

Utilizing blockchain, the identical cash is transmitted in minutes, with out middlemen. The charges are usually a lot much less, too.

2. Shopping for Stuff On-line or In-Retailer

An increasing number of on-line shops (and even some diners) settle for crypto as a fee choice. Consumers pays with Bitcoin, Ethereum, or stablecoins like USDT or USDC, and the shop will get paid both in crypto or routinely transformed into common forex.

Such an choice really has many advantages for shops, akin to:

- No chargeback or bank card fraud

- Decrease transaction charges in comparison with banks or fee programs

- Quicker entry to your cash

3. Enterprise-to-Enterprise (B2B) Funds

Blockchain additionally allows corporations to pay one another for a complete vary of issues, akin to bulk orders, invoices, and funds between subsidiaries of an organization positioned in several nations.

Good contracts pays routinely upon satisfaction of sure circumstances, e.g., upon supply verification.

For instance, JPMorgan’s JPM Coin permits companies to switch funds in actual time throughout their very own community.

4. Tiny Funds for Content material and Streaming

With typical fee programs, it’s not worthwhile to ship very small funds (like a couple of pennies) as a result of the charges are usually too excessive. However blockchain makes “micropayments” extra possible and low-cost.

This fashion is nice for:

- Tipping housekeepers

- Paying per second of music or video streamed

- Paying per article learn or per click on

5. Freelance & Gig Employee Funds

Freelancers, distant employees, and gig employees should wait days at occasions to receives a commission, particularly if they’re exterior the nation. And banks get to take excessive margins and charges with trade charges.

Blockchain funds tackle this limitation by enabling corporations to pay straight into an worker’s pockets, practically immediately and with no ridiculous charges.

As an illustration, Sablier permits its employers to “stream” funds in real-time so somebody can receives a commission minute-by-minute.

6. Charities & Support Distribution

Blockchain provides extra readability to donations. Donors can see precisely the place their cash goes, and charities can assure that the cash is getting used because it was meant to be.

It additionally works in occasions of disaster, when individuals are in pressing want of assist and don’t essentially have entry to a financial institution.

Instance: The UN World Meals Programme employed blockchain to concern meals vouchers to refugees in Jordan.

Challenges in Blockchain Fee Adoption

Blockchain funds, like with any new tech, have a couple of peculiarities stopping broader adoption.

One of the vital distinguished challenges is regulation. In some nations, crypto is equal to common money. In others, it’s taxed like property, or unlawful altogether.

That inconsistency makes it onerous for individuals and companies to know what they’ll and may’t do. Additionally, most of the monetary laws don’t fairly match the way in which blockchain works, so compliance isn’t at all times manageable.

Then comes the usability issue. Crypto wallets, lengthy pockets addresses, cyber incidents, and personal keys could be perplexing to those that should not technically inclined.

If customers lose their personal keys or unintentionally ship cash to the flawed tackle, they often can’t get it again. Till utilizing crypto turns into as easy and protected as utilizing an everyday banking app, many individuals will seemingly keep away.

Volatility is yet one more problem. Cryptocurrencies (irrespective of whether or not Bitcoin or some lately issued asset) can fluctuate up or down in worth in a break up second.

It’s onerous to make use of them for on a regular basis purchases as a result of nobody needs to spend $10 on one thing right now solely to seek out that cash was really price $7 tomorrow. Stablecoins (like USDT or USDC), that are tied to the worth of conventional currencies, assist with this, however they’re not but extensively accepted.

And at last, there’s adoption. Whereas some corporations and on-line shops are beginning to settle for crypto, most don’t. Till blockchain funds are accepted by extra platforms, apps, and point-of-sale programs, they’ll be extra of a distinct segment product than one thing that individuals use day-after-day.

Learn how to Construct a Blockchain Fee Resolution

Need to construct your personal blockchain fee platform? For exchanging cryptocurrencies between prospects, for buying it in a web based retailer, or for paying enterprise invoices, it begins with a considerable plan and the proper individuals to execute it.

1. Begin with Your Use Case

Previous to beginning improvement, it’s essential resolve what kind of fee answer you want. Are you solely concerned about peer-to-peer transfers? To allow customers to take a look at with crypto? Or perhaps to deal with cross-border company funds?

Your use case will dictate the remainder of the method, from which blockchain to collaborate with to what options and person interface you’ll be required to ship.

2. Select the Finest Blockchain

Totally different blockchains have completely different strengths, so it would be best to choose the very best high quality one that matches your use.

Bitcoin is nice for easy transactions, Ethereum is good for good contracts for added performance, and chains like Solana, Polygon, or BNB Chain supply excessive speeds and decrease charges.

In case you are making one thing for a corporation or group, you may even use a personal blockchain for extra management and confidentiality.

3. Select a Software program Growth Agency

Missing an inner workforce of skilled blockchain builders, you’ll seemingly must contract a software program firm that focuses on blockchain improvement.

A very good improvement associate like SCAND will permit you to create an easy-to-use answer, without having to take care of all of the complicated technicalities your self, for instance, structure, pockets integration, good contracts, safety, and testing.

4. Launch, Study, and Enhance

When your platform is prepared and totally examined, it’s time to launch. After going stay, it’s necessary to rigorously monitor how your system is performing. You (or your software program improvement workforce) will seemingly should make tweaks, repair small bugs, and optimize based mostly on suggestions.

Carefully monitoring person conduct, transaction charges, and total system well being will allow you to determine points early on and maintain refining the expertise over time.

The Way forward for Blockchain in Funds

Blockchain is quickly transitioning from a buzzword to a know-how that’s being applied in on a regular basis funds, and its prospects are encouraging.

An increasing number of, banks and monetary establishments are beginning to combine blockchain into their present programs, which allows them to simplify their processes whereas nonetheless being clear, fulfilling the mandatory laws and compliance necessities.

Within the meantime, decentralized finance (DeFi) is rising by leaps and bounds. These websites permit customers to lend, borrow, and ship cash with out the involvement of a financial institution in any respect. Early days, however DeFi reveals how blockchain has the potential to vary the character of finance.

Stablecoins, cryptocurrencies tied to real-world currencies just like the US greenback, are additionally more and more a giant portion of blockchain funds. Stablecoins mix the quick, cheap advantages of crypto with the steady worth of conventional cash, which makes them good for each day use.

And now we’re beginning to see AI and funds work collectively. AI helps with fraud detection, fee monitoring, and safety upgrades. Paired with blockchain’s transparency, this makes funds each smarter and safer.

Typically talking, blockchain is now not one thing of the longer term — it’s already altering the way in which individuals ship, get, and work with cash. And on the price issues are shifting, it’s solely going to be extra widespread.

Ceaselessly Requested Questions (FAQs)

How does blockchain help with funds?

It permits individuals to ship cash from one to a different straight, bypassing banks and the necessity for intermediaries. This may be quicker, inexpensive, and performance at any time, even internationally.

Is blockchain for funds protected to make use of?

Sure! Blockchain has robust safety to guard transactions. However do use respected apps and defend your account particulars.

What’s a stablecoin?

Stablecoins are distinctive cryptocurrencies mounted to conventional cash just like the US greenback. They don’t change a lot in worth, so they’re simpler to make use of for on a regular basis funds.

What’s constructive about blockchain funds?

From the enterprise facet, they’re speedier and cheaper than common funds, and work properly between nations, even in areas the place banks are tough to make use of.

What are the downsides of utilizing blockchain cash transfers?

By and enormous, probably the most widespread issues are unstable costs (aside from stablecoins), unclear laws, and restricted adoption.

Will blockchain substitute regular funds?

No, not simply but. But it surely’s gaining momentum as a possible substitute and can quickly increase regular fee programs.