Key Notes

- Bitcoin’s rally to $113,700 triggered $652.7 million in liquidations with shorts accounting for 88% of losses.

- Former Binance CEO CZ posted cryptic Bitcoin message gaining 970,000 views through the all-time excessive surge.

- Technical indicators present bullish MACD crossover and breakout above Bollinger Bands supporting continued momentum towards $120,000.

Bitcoin

BTC

$111 331

24h volatility:

2.2%

Market cap:

$2.21 T

Vol. 24h:

$35.77 B

value entered one other main upswing on Thursday, July 10, amid a mixture of macro optimism and speculative momentum. With US President Trump renewing requires charge cuts, BTC value swung previous the $113,700 mark to set new all time highs.

Donald J. Trump Reality Social 07.10.25 10:28 AM EST pic.twitter.com/YJikaFW705

— Commentary Donald J. Trump Posts From Reality Social (@TrumpDailyPosts) July 10, 2025

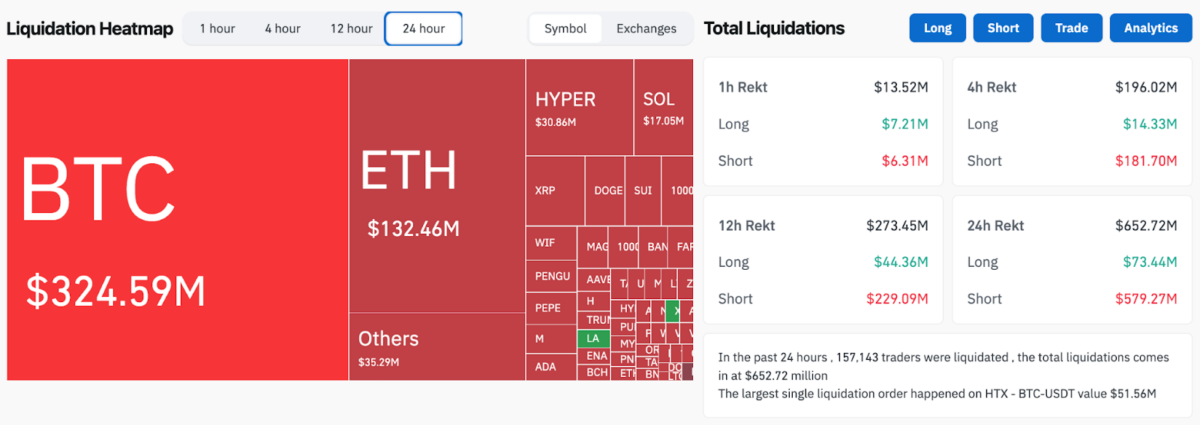

A more in-depth have a look at the derivatives markets exhibits the rally caught many merchants unawares. As BTC value touched $113,000, liquidations surged, wiping out $652.7 million in 24 hours. Of this, quick place losses of $579.27 million made up greater than 88%, in response to Coinglass’ liquidation information, reflecting aggressive buying and selling amongst bulls.

Crypto market liquidation, July 10, 2025 | Supply: Coinglass

CZ Posts Cryptic Bitcoin Message Amid ATH Frenzy

Former Binance CEO Changpeng Zhao (CZ) broke his silence throughout Bitcoin’s surge, posting a cryptic but pointed message on X.

Hope you acquire the dip. https://t.co/P13m3r5eee

— CZ 🔶 BNB (@cz_binance) July 9, 2025

Regardless of current authorized battles and regulatory scrutiny, Zhao stays a key opinion chief throughout the international crypto neighborhood.

The quote has since gained over 970,000 views in lower than 24 hours, with many deciphering CZ’s message as an endorsement of Bitcoin’s long-term progress potential amid risky market cycles.

With Bitcoin now firmly in value discovery, short-term volatility is anticipated. If bulls maintain the $110K degree as help, the subsequent psychological goal lies round $120,000, pushed by derivatives momentum and ETF inflows.

Giant sized liquidations such because the $578 million quick positions worn out within the final 24 hours typically clear the trail for upward value motion. Nonetheless, it may additionally set the stage for speedy correction dangers if numerous BTC merchants choose to guide early earnings or rotate in direction of altcoins.

Bitcoin Worth Forecast: Bulls Eye $120K as Momentum Builds Above Bollinger Band

Bitcoin value is hovering above the $113,300 degree on July 10, capping a two-day 6.1% rally. The breakout above $112,849, the higher Bollinger Band, alerts robust momentum and hints {that a} bullish continuation is probably going.

Extra so, the MACD indicator flipped bullish earlier this week. The MACD line (1,433) is nicely above the sign line (960), exhibiting accelerating shopping for strain. Histogram bars are increasing, additional validating the bullish crossover.

Bitcoin value forecast | Supply: TradingView

BTC additionally holds nicely above the 20-day Easy Shifting Common (SMA) at $107,494, and the center Bollinger Band is trending upward. This technical alignment helps continued value discovery if bulls defend help above $110,500.

If consumers keep management, the subsequent main psychological goal is $120,000, adopted by a longer-term push towards $135,000. On the draw back, a detailed again under $110,000 may set off short-term profit-taking, with the subsequent main help clusters at $107,000 and $102,000.

Greatest Pockets Powers the Bitcoin Period with Seamless Crypto Entry

As Bitcoin pushes into new all-time highs, buyers are turning to Greatest Pockets for safe, early entry to next-gen tokens and monetary instruments.

With over $13.79 million raised, Greatest Pockets is capitalizing on crypto’s enlargement by providing decrease transaction charges, early entry to token launches, larger staking rewards, and full governance rights to $BEST holders. Go to the official Greatest Pockets web site to be a part of the subsequent bull cycle.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at the moment finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.